Big four bank share buyback explained

Alexa Tran

4 years ago · 3 min read

Last week, ANZ Bank unveiled a share buyback worth $1.5 billion, declaring it aims to return surplus capital to shareholders and support pandemic-affected customers.

This announcement came hours after the Australian Prudential Regulation Authority said it would provide regulatory relief to banks that offered vulnerable customers loan repayment deferrals.

ANZ chief executive Shayne Elliott said: ‘The strength of our business means we are well placed to fulfil needs of our customers and the broader community while still actively managing our capital.’

ANZ is showing that they are ready and able to provide assistance to both remaining shareholders and customers during the crisis.

How does share buyback work?

Banks have access to quite a bit of cash right now after banks suspended dividends last year and took provisions for bad debts that ended up being overly cautious. Relatively high earnings, assets sell-off and low interest rates have also added to bank cash stockpile.

When the company is flushed, it has options for what to do with its money:

- Buy other companies

- Spend on research and development

- Buy new equipment, buildings and technologies.

- OR return money to little baby shareholders. This can take the form of dividends or stock buybacks.

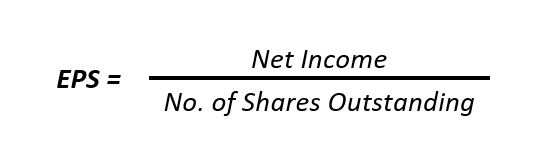

With share buyback, the company purchases its own shares from these shareholders, taking them off the market and leaving fewer shares outstanding. This changes the math in the remaining shares in a key way. It boosts the metric called Earning Per Share (EPS).

So when the number of shares shrinks, the EPS rises. In other words, the pie is divided into fewer pieces. Higher per share earnings make stocks look GOOD and more valuable and the company looks financially healthy, attracting more investors.

Reasons for buybacks

Carrying large amounts of equity cash on the balance sheet becomes more of a burden than a blessing, especially when there are no potential growth opportunities in sight. Holding onto unused equity means sharing ownership with many baby shareholders – each demands returns on their investment – that means the bank would have to pay for holding the funds it isn’t using, if that makes sense.

This modest buyback helps reduce the overall cost of capital of ANZ by 35 basis points. And their shares climbed 1.5 per cent in early trading on Tuesday, while the other three major banks lagged behind.

“After reviewing opti